With the launch of our current account on the horizon (now live), this initiative became a top priority due to its potential to significantly shape the overall user experience.While the proposed solution needed to benefit all users, our core focus was on multi-product users — those expected to interact more frequently with payment features following the introduction of the current account. For these users, payments were becoming a central part of their financial journey, and it was critical that we designed an experience that was efficient, seamless, and intuitive.The project aimed to streamline the end-to-end payment flow, ensuring users could manage their transactions effortlessly while reinforcing trust and confidence Zopa.

To ensure we delivered meaningful impact, we defined clear key performance indicators (KPIs) for measuring success:

Understand how customer payment habits are formed

Understand pre-emptive payment instincts

To design an intuitive and market-leading payment experience, I conducted a comprehensive competitive analysis focusing on both incumbent banks and challenger banks. The goal was to understand how the industry approaches payment flows, identify best practices, and uncover gaps and opportunities where we could differentiate. I explored:

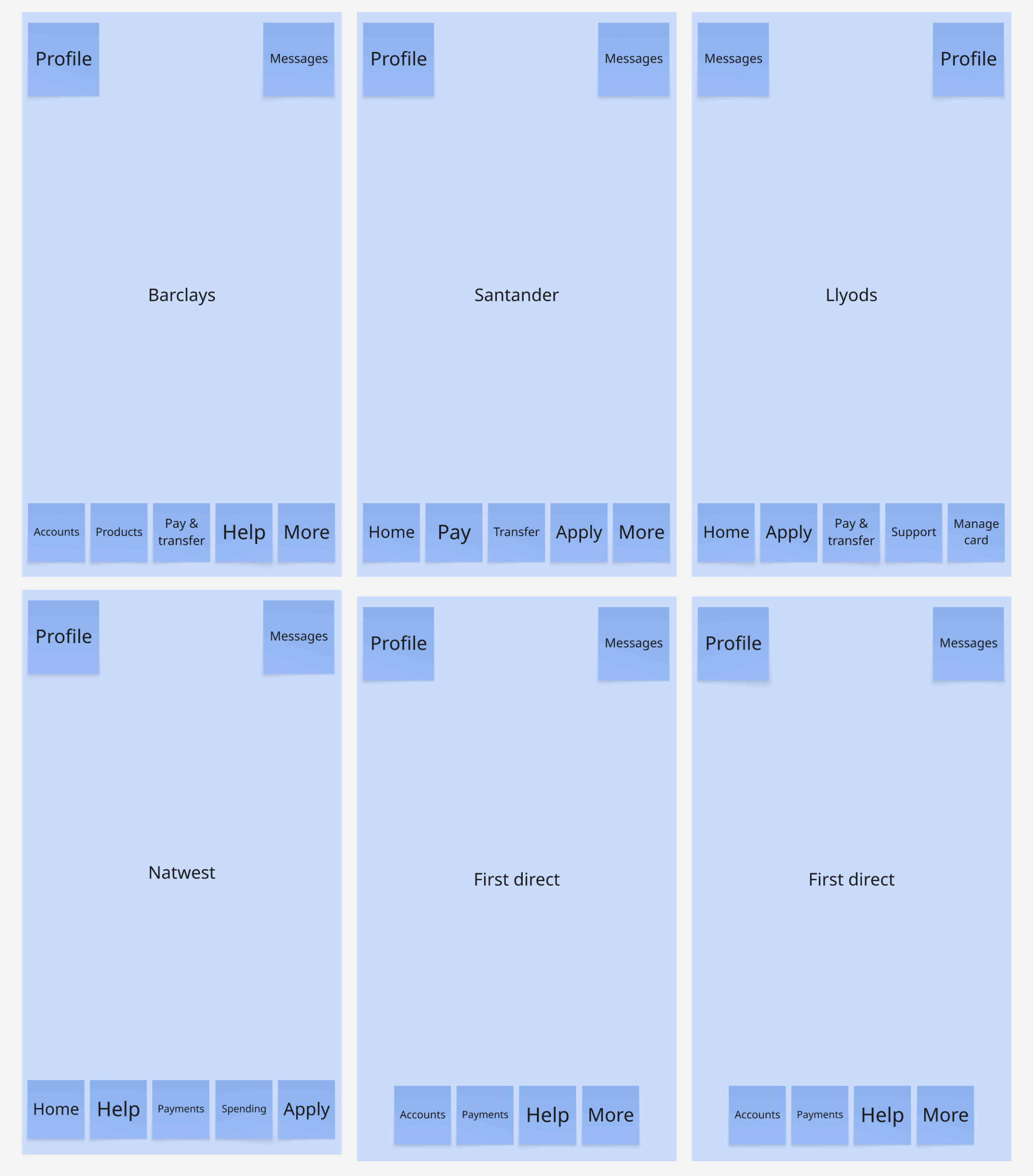

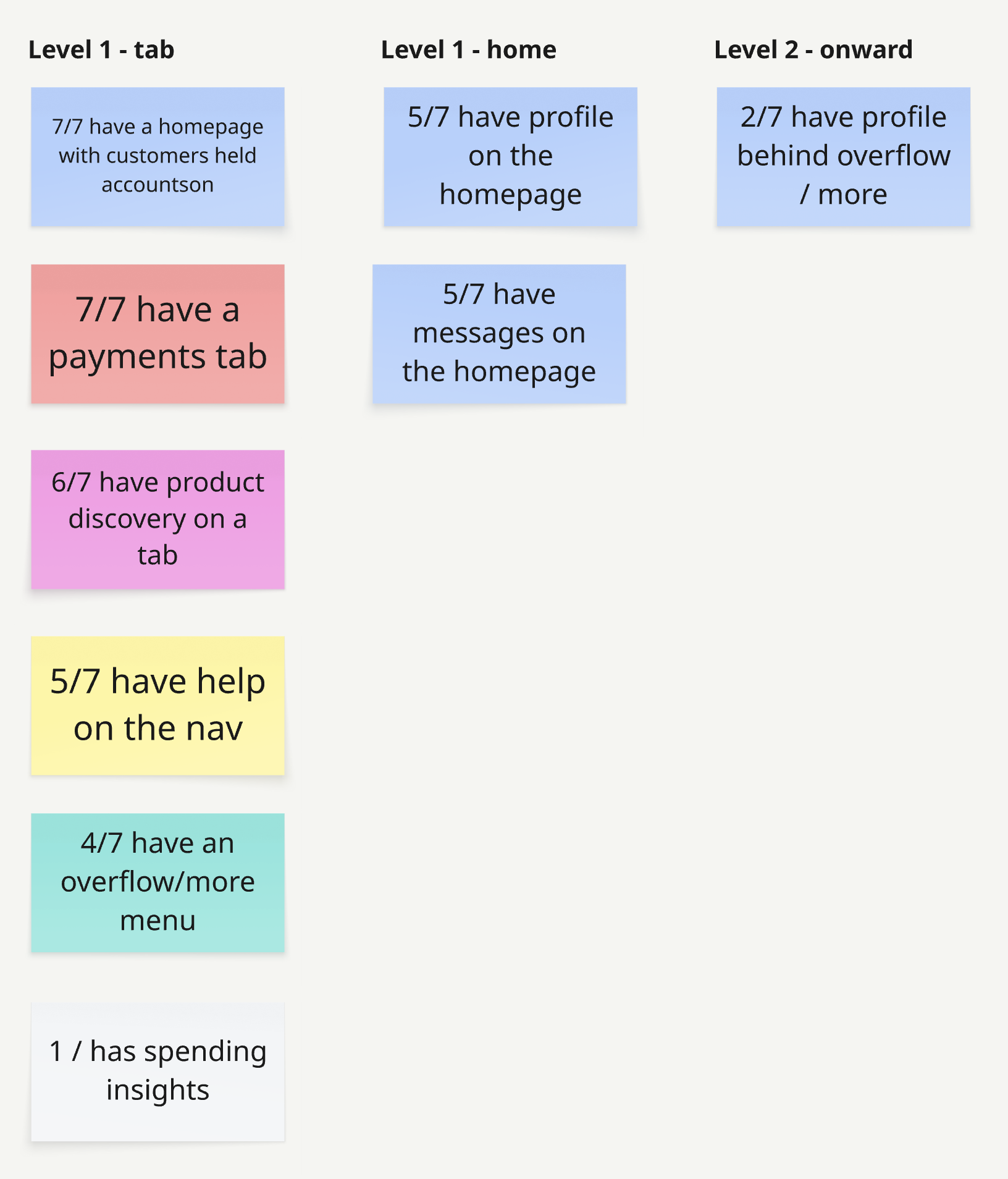

The incumbents

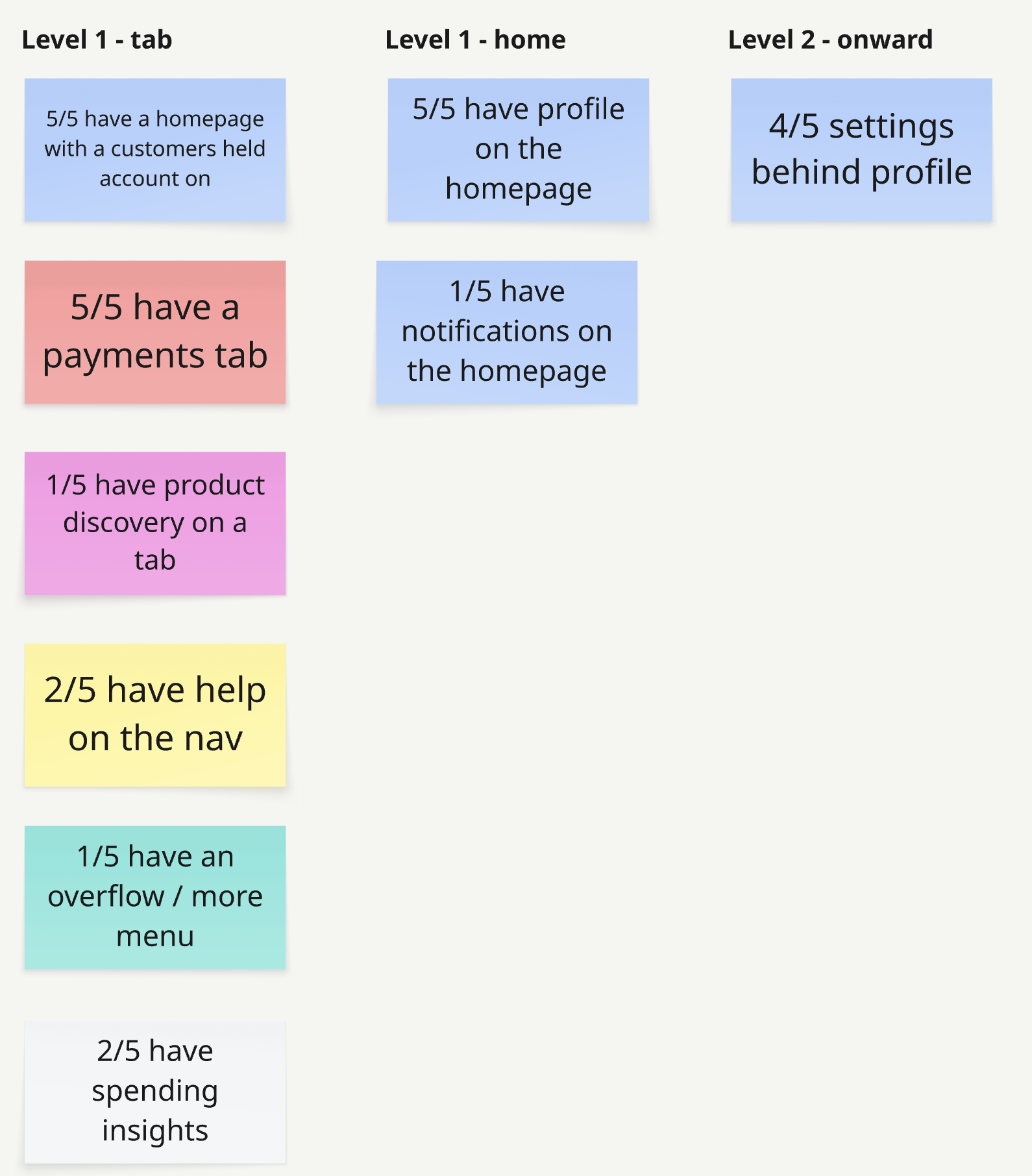

The challengers

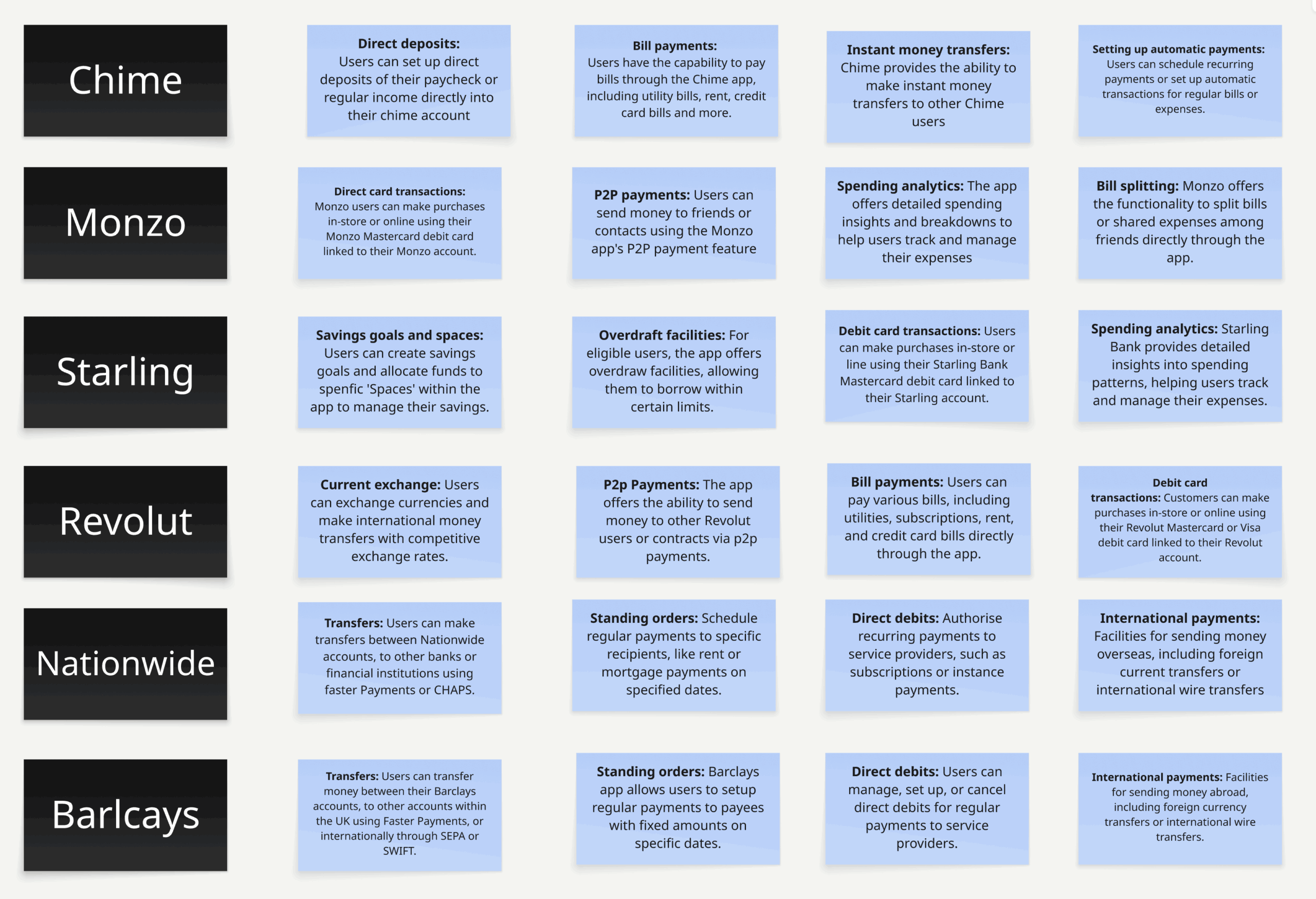

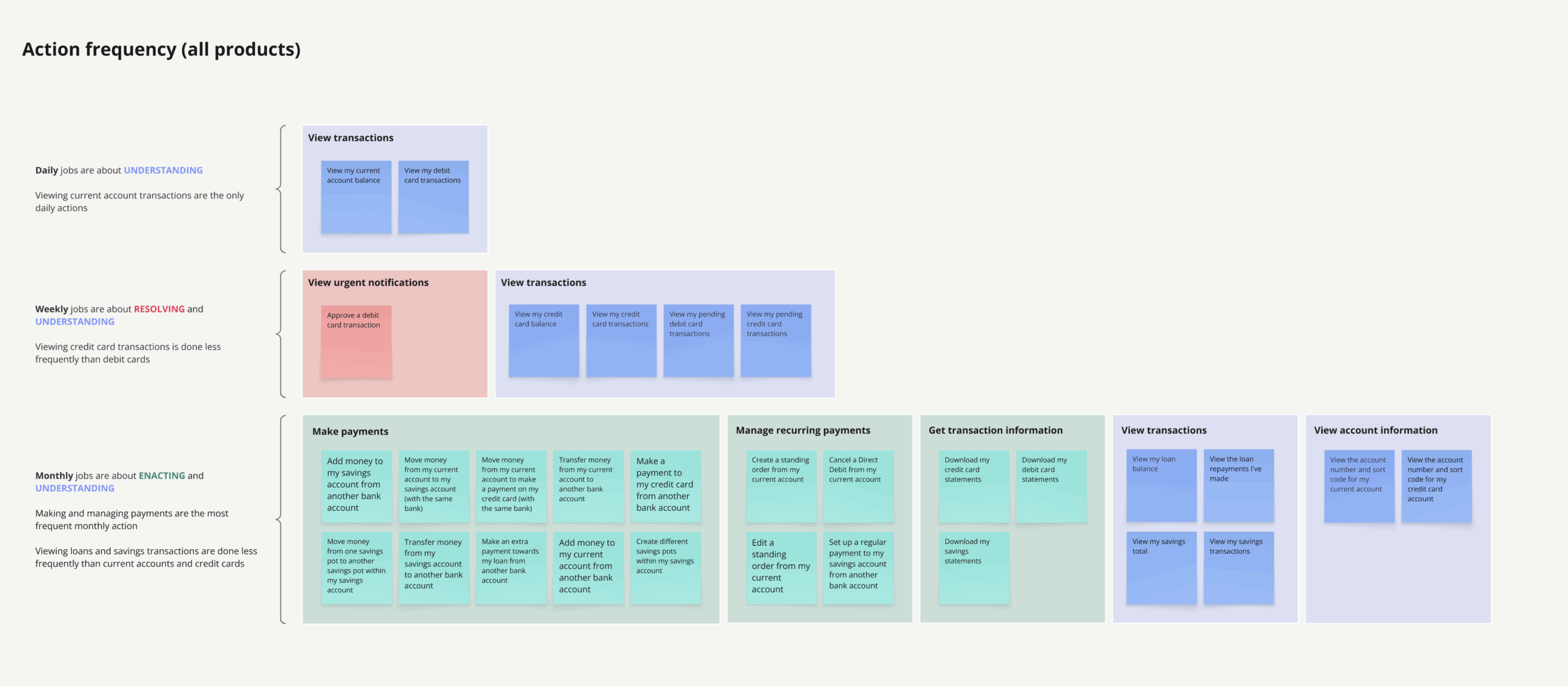

A part of defining the optimal payments experience, I explored the different “jobs” that incumbent and challenger banks were enabling for their users. The goal was to understand what problems they were solving, where they were adding value, and where gaps existed. This would inform what jobs we should be focusing on at a foundation level.

I needed to understand the existing landscape within the current Zopa app. This involved mapping out all payment-related jobs across our different products.The goal was to identify what tasks users were performing, how frequently they were doing them, and how well our current IA supported those journeys. I conducted a deep dive into the app’s payment flows to evaluate:

Alongside this, I mapped the existing information architecture to understand how payment actions were distributed across products and whether users were required to jump between multiple journeys to achieve simple goals.

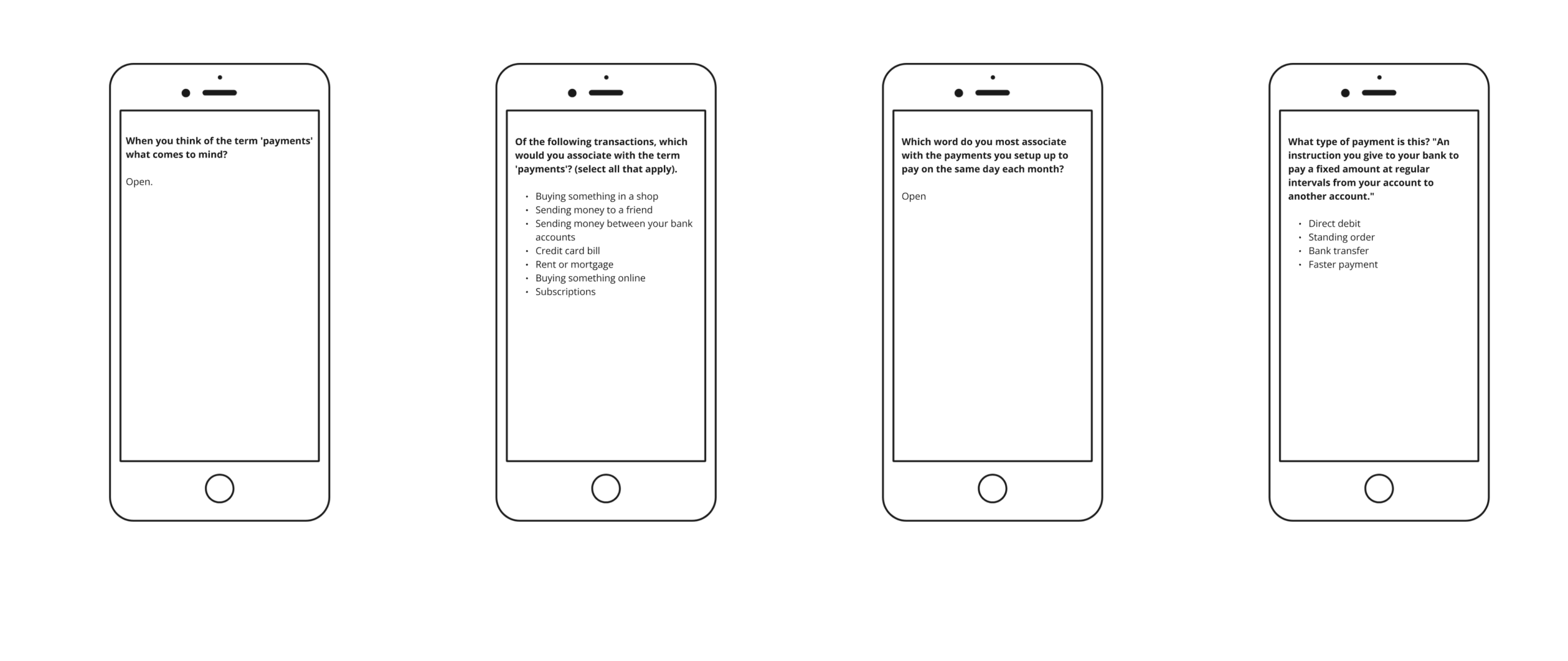

To ensure we gathered consistent, valuable insights from our user interviews, I created a structured discussion guide tailored to our goal of defining the optimal payments experience. The guide acted as a framework to steer conversations while leaving room for users to share unexpected insights about their behaviours, frustrations, and needs. The guide was broken down into:

Insights

Payment understanding and behaviour

Banking preferences

Payment management preferences

Customers prioritise understanding the prupose and significance of payments, categorising them by intent (e.g. bills, daily spending, subscriptions). Preferences vary in handling payment types, with some favoring automation, while others seek manual control over certain payments.

Customers prefer streamlined payment processes, emphasing importance of simplicity and efficieny. Some express dissastisfaction with certain banking apps, citing challenges in navigation, lack of comprehensive insights and frustraiton with multi-step processes.

Customers value clear visiblity into transactions and categorised spending ,especially for essential and non-essential expenses. Preferences for payment execution vary, with expectations of streamlined processes within current account cards or payment tabs.

Theme: Payments tab perceived as control

The Payments tab serves as a centralised control centre for customers, indicating a distinct preference for holistic payment management rather than merely transaction execution. This section is perceived by customers as a comprehensive hub designed for a multifaceted approach to handling their payments.

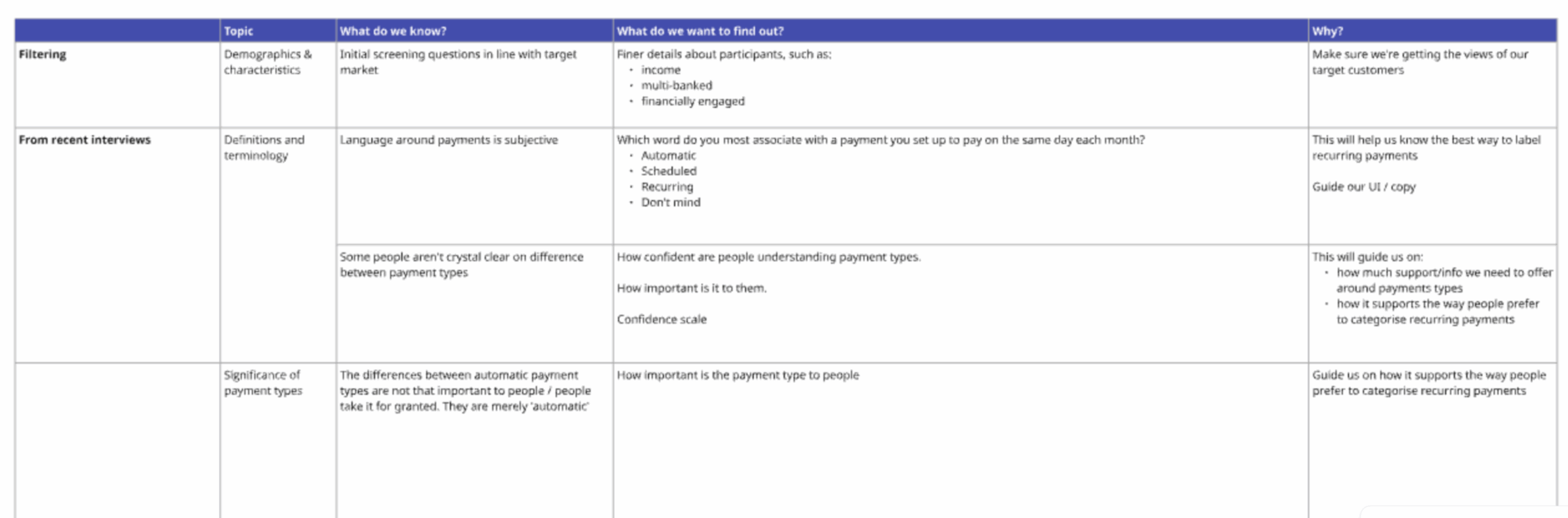

Too complement the qualitative insights from user interviews, I designed and conducted a quantitative survey aimed at gathering a broader understanding of user behaviours, perceptions, and challenges around payments and payment management within their banking apps.The goal was to capture comprehensive insights into how users think about, manage, and prioritise payment-related tasks, helping us validate assumptions and highlight opportunities for improvement within our own product experience.

Insights

Organisation of financial transactions

Managing automatic monthly payments

Payment management preferences

A significant portion relies on banking apps to organise transactions. Various methods for categorisation, including by date, type, importance, and separate pots for different expenses. When it comes to organising transactions, users have their unique methods, like categorisation and using external tools. Most users find it helpful to have payments sorted, providing them with clearer insights into their spending habits.

Users prefer to see automatic monthly payments grouped by payment type, suggesting an opportunity for us to streamline the management of recurring transactions for a smoother user experience.

Majority of users report a positive impact on their financial well-being. This positivity is attributed to feelings of control, convenience, organisation, and achieving financial goals

Efficient payment organisation

Users want to efficiently categorise their payments by intent, making the process intuitive and engaging for better financial understanding.

Holistic payment management

Users seek a central hub within the "Payments" tab to empower them in financial decisions, providing a comprehensive platform for understanding, and finding inspiration in financial transactions.

Streamlined categorisation system

Users need an efficient categorization system that automatically organises payments into clear and relevant categories, saving time and effort in managing transactions.

Payment movement predicitons

Users want the ability to anticipate potential financial fluctuations based on their payment history and simulate the impact of upcoming payments on their account balance

Payment Insights Drill-Down

Users desire the ability to drill down into detailed insights for each payment within the "Payments" tab, including transaction purpose, past history, and future projections.

Source of financial inspiration

Users aspire to have the "Payments" tab serve as a source of inspiration, actively guiding them in their financial decisions and money moves.

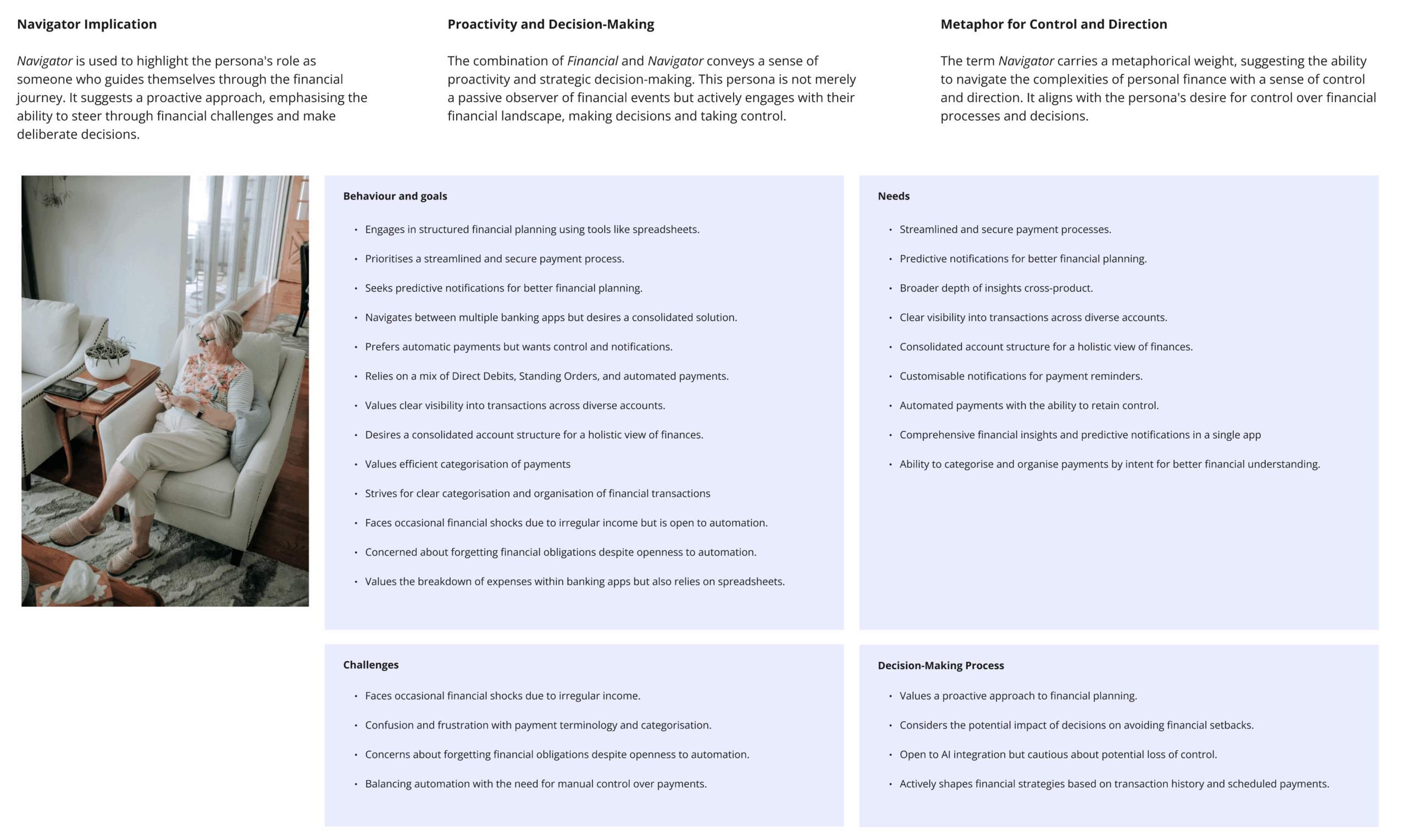

Taking the insights gathered from user interviews, surveys, and the card sorting exercise, I translated our findings into a data-informed persona that captured the behaviours, goals, and pain points of our core users.Rather than creating a static deliverable, this persona served as a living reference point for the team, a tool to align stakeholders, guide design decisions, and keep us grounded in real user needs.

To be successful in delivering an optimal payments experience, it required cross-functional alignment. The insights we uncovered during research touched multiple areas of the business, meaning no single team could deliver impact in isolation. To address this, I brought together product teams from across the organisation and ran a collaborative workshop focused on context sharing, ownership mapping, and action planning. This workshop aligned stakeholders on priorities, ownership, and next steps, creating a shared understanding of where effort should be focused to deliver the highest impact.

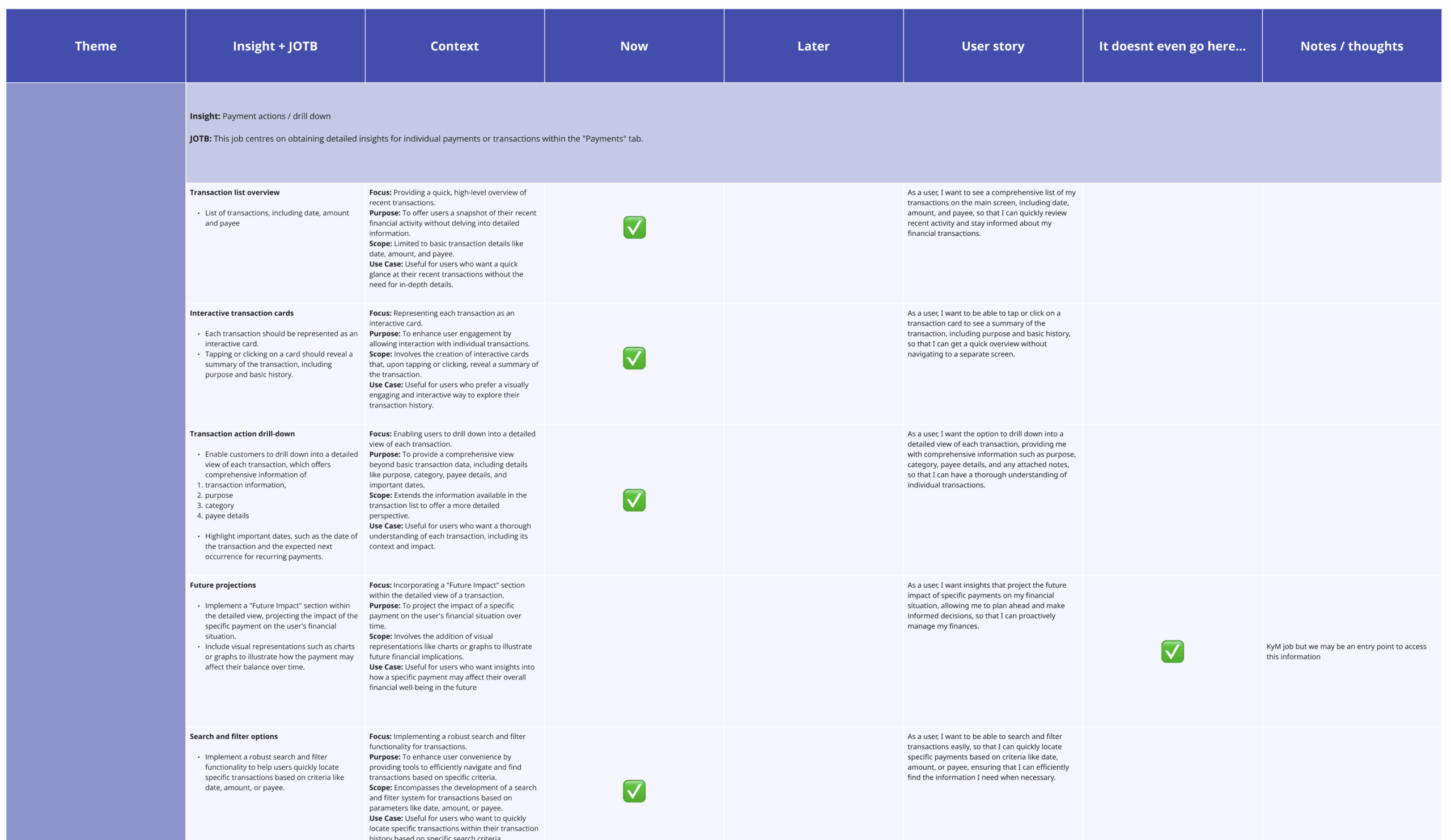

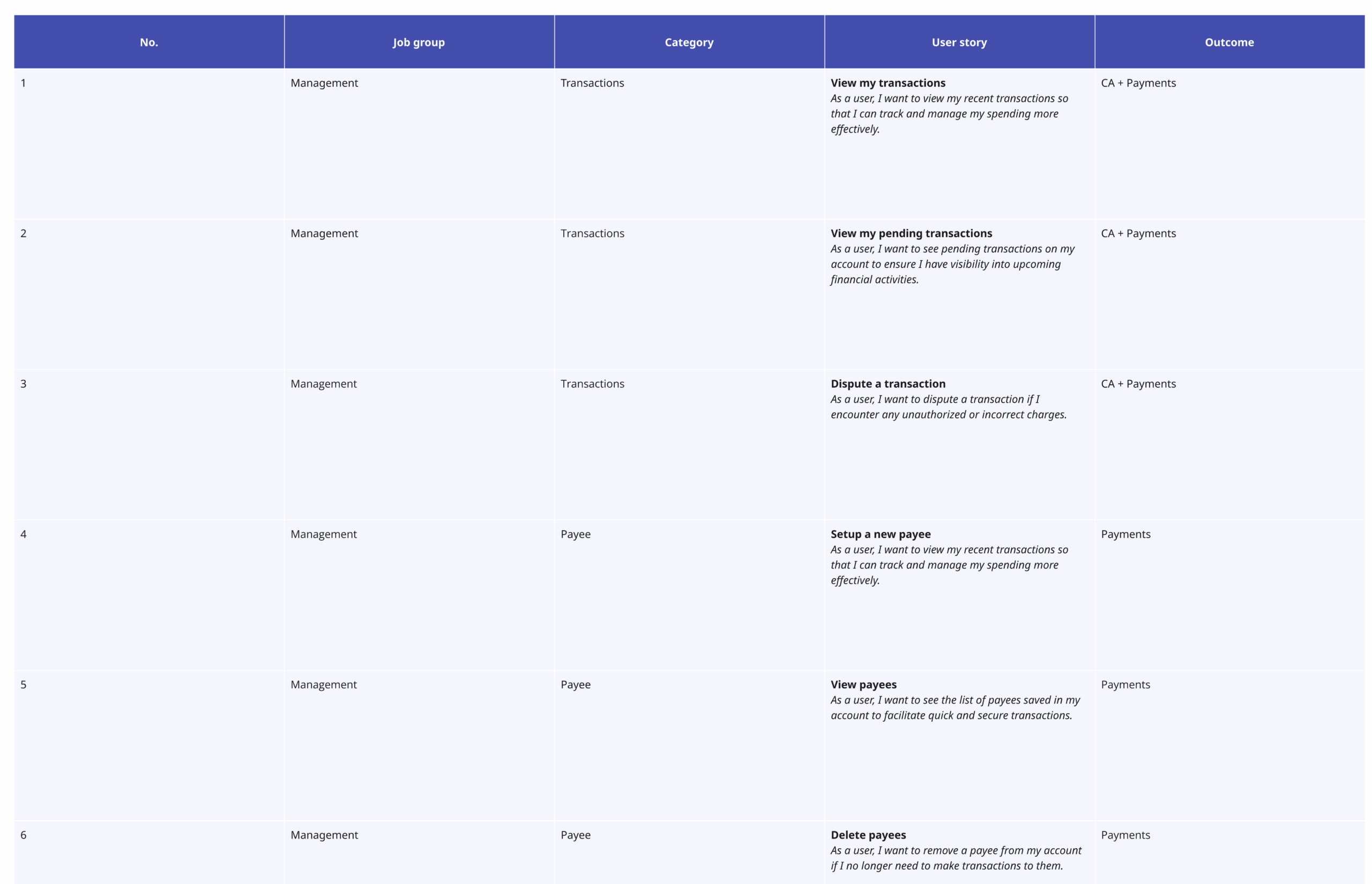

Building on the alignment, I needed to ensure that there were actionable deliverables that multiple product teams could use to inform their roadmaps. I collaborated closely with each team to prioritise insights and determine which payment jobs needed to be addressed immediately versus those that could be tackled later.

Where jobs were deprioritised for now, I facilitated discussions around downstream impacts on other teams to ensure dependencies were well understood and managed.

For the current account launch, I partnered with the product team to define the MVP payment jobs and establish the correct entry points within the app to support a seamless user experience. This alignment resulted in a finalised table of prioritised MVP jobs, giving all product teams a shared reference point to drive consistency and focus across the business.

Redefining the payments experience was one of the most cross-functional and product research driven projects I’ve led to date. It required balancing user needs, business priorities, and technical constraints while collaborating with multiple product teams across the organisation. Looking back, there are several key reflections from the process:

Grounding Design in Research

Combining user interviews, surveys, and card sorting allowed us to deeply understand user behaviours, pain points, and mental models around payments. These insights directly shaped the information architecture and prioritisation of MVP jobs.

Cross team alignment

By running collaborative workshops and creating clear deliverables, I was able to bring multiple product teams together and establish shared ownership of the payments vision.

A clear MVP strategy

Defining core payment jobs and agreeing on entry points across products gave us a focused roadmap and ensured the current account launch delivered a cohesive experience for users.

Designing for scale

The work not only improved the immediate payment experience but also laid the groundwork for a future-proofed, centralised payments hub.

Balancing speed vs depth

With the current account launch deadline, we had to deliver impact quickly while ensuring our design decisions were grounded in solid insights.

Fragmented journeys

One of the biggest learnings was just how disconnected existing payment flows were across products. Addressing this highlighted the need for a holistic, app-wide strategy rather than isolated feature fixes.

Ths project not only defined the optimal payments experience, but delivered a prioritise set of MVP jobs that all product teams could point to. This influenceda a new payments architecture based on real user behaviours, while setting a precedent fow how we approach multi-product journeys in the future. It has created a strong foundation for scaling the app's payment ecosystem, ensuring our customers have a faster, familiar and more intuitive experience when making their money.