Zopa

To enhance Zopa’s Auto-Save feature by leveraging open banking to give customers greater flexibility and control when funding their savings. The goal was to simplify the process by enabling users to automatically split deposits across multiple savings pots, reducing manual effort while maintaining transparency and choice.

To define what success looked like for the Auto-Save enhancement, we had clear, measurable goals focused on adoption, engagement, and customer value. The feature’s impact would be assessed using the following KPIs:

To design an intuitive and market-leading payment experience, I conducted a comprehensive competitive analysis focusing on both incumbent banks and challenger banks. The goal was to understand how the industry approaches payment flows, identify best practices, and uncover gaps and opportunities where we could differentiate. I explored:

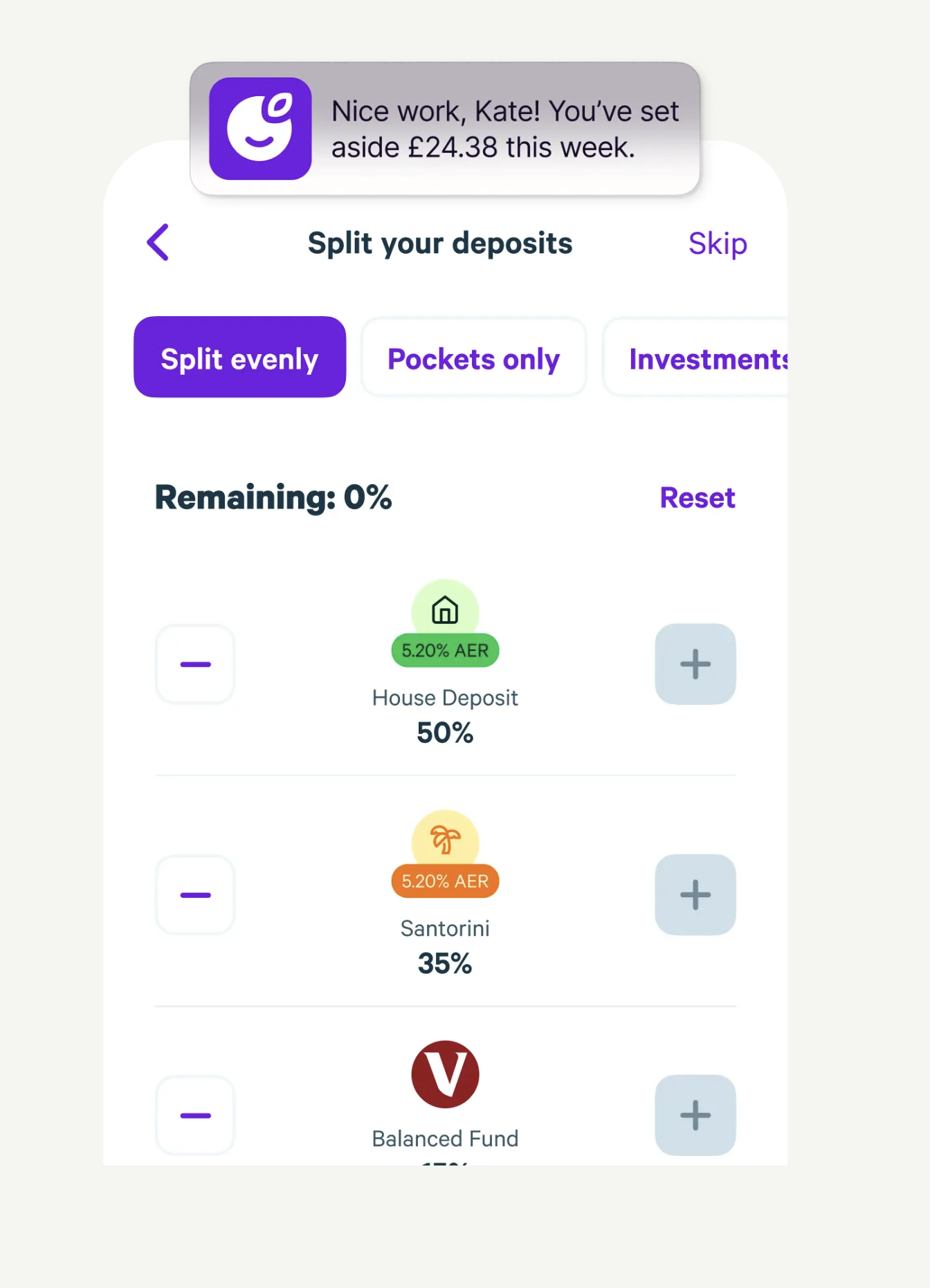

Plum

Plum uses artificial intelligence to analyse income and spending habits, then calculates an affordable amount to save each month. This amount is automatically transferred from your bank account to your Plum savings "pockets." Users can set smart rules for how and when these transfers occur, making the process flexible and customizable.

Monzo

Monzo's autosave feature, known primarily through its "Pots" and "Round-ups," is designed to help users save effortlessly.

Round-ups

This feature automatically rounds up your card transactions to the nearest pound and saves the spare change into a designated Pot. For example, if you spend £2.50 on a coffee, Monzo will round up the transaction to £3 and transfer 50p into your Pot. Premium users can increase this round-up to 2, 5, or 10 times the spare change, accelerating their savings.

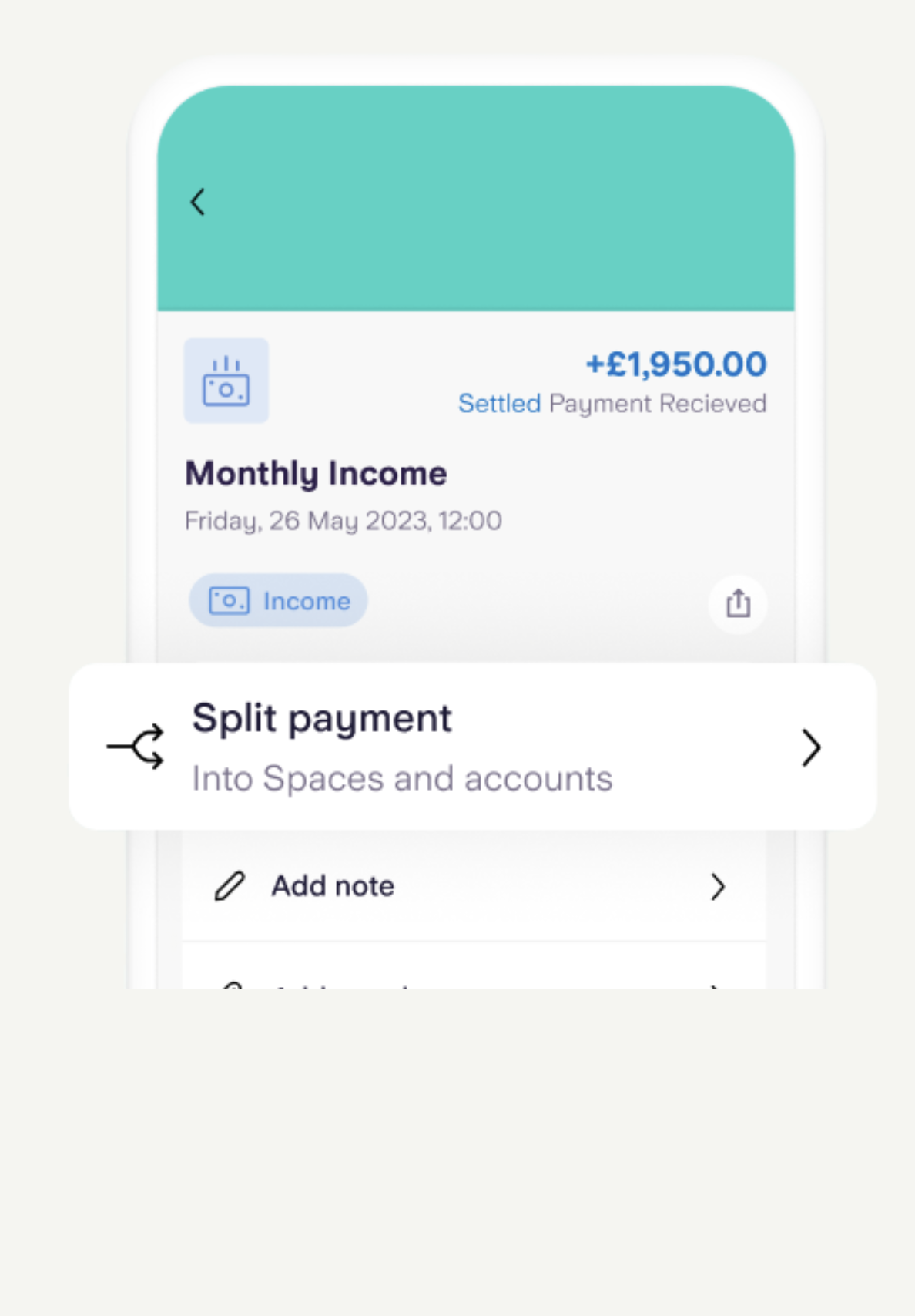

Starling

Starling Bank's autosave feature, called "Savings Spaces," designed to help users manage and grow their savings effortlessly.

Savings Spaces

These are virtual piggy banks within your main Starling account. You can create multiple Spaces for different savings goals, such as holidays, emergency funds, or upcoming expenses. The money in these Spaces is kept separate from your main account balance, helping you to visualize and achieve your savings goals more effectively

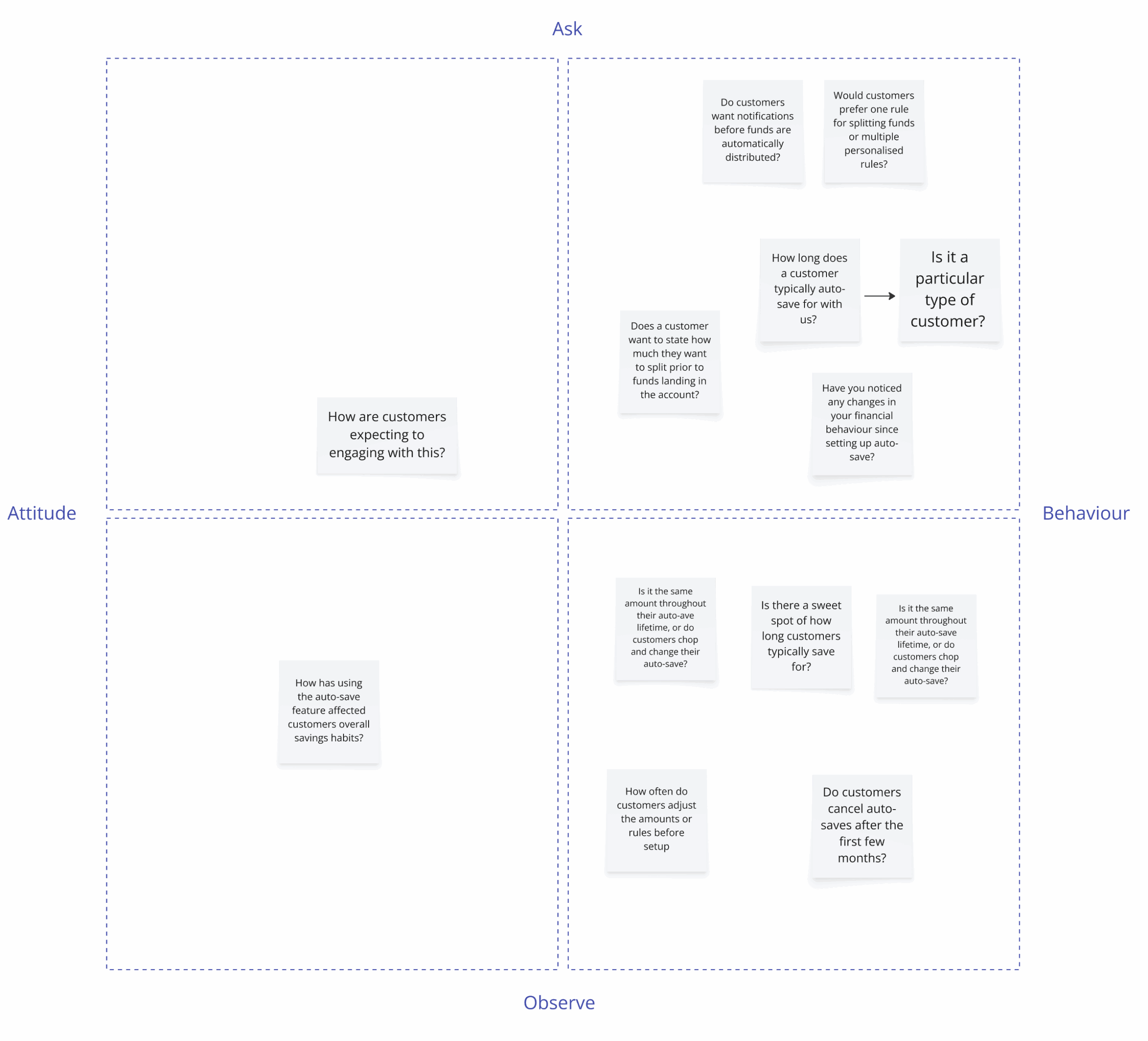

To set the foundations for designing an experience that enables customers to auto-save into multiple savings pots, I ran a collaborative workshop with the product, design, and research teams. The goal was to align on what we already knew about our customers and identify the knowledge gaps that needed further validation.

Workshop objectives

Our workshop revealed that while customers want to save regularly, their behaviours are inconsistent and fragmented. Many contribute to their savings once a month, but the amounts vary, and most manually move money between pots after making a deposit.

Although we know customers value control over how their savings are distributed, we don’t fully understand:

To close these gaps, I proposed conducting our customer interviews which were designed to validate our assumptions, uncover new insights, and ensure we were solving the right problems before moving into design. This was important and had immediate buy-in as it was clear that were a number of unknowns that we needed to get to grips with and better understand.

What I did and explored

Key takeaways

With a clearer understanding of customer behaviours, attitudes, and needs from our research, the next step was to start considering how we transition to the design phase. Whilst we learnt a lot from our research, we didn't have alignment immediately in terms of the focus of the experience for our customers and business. We arrived at the decision of 2 hypotheses which would give me path forward to shape the designs.

Hypothesis 1: Users prefer percentage-based rules over fixed amounts.

Hypothesis 2: Users want both a global Auto-Save setting and per-pot overrides.

Our goal

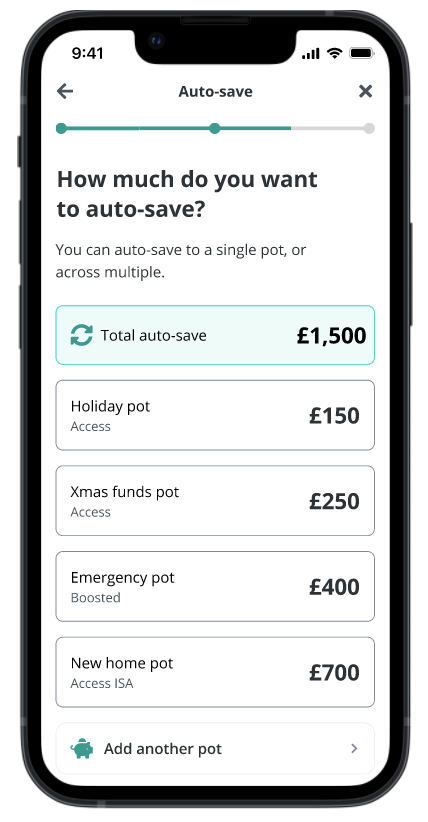

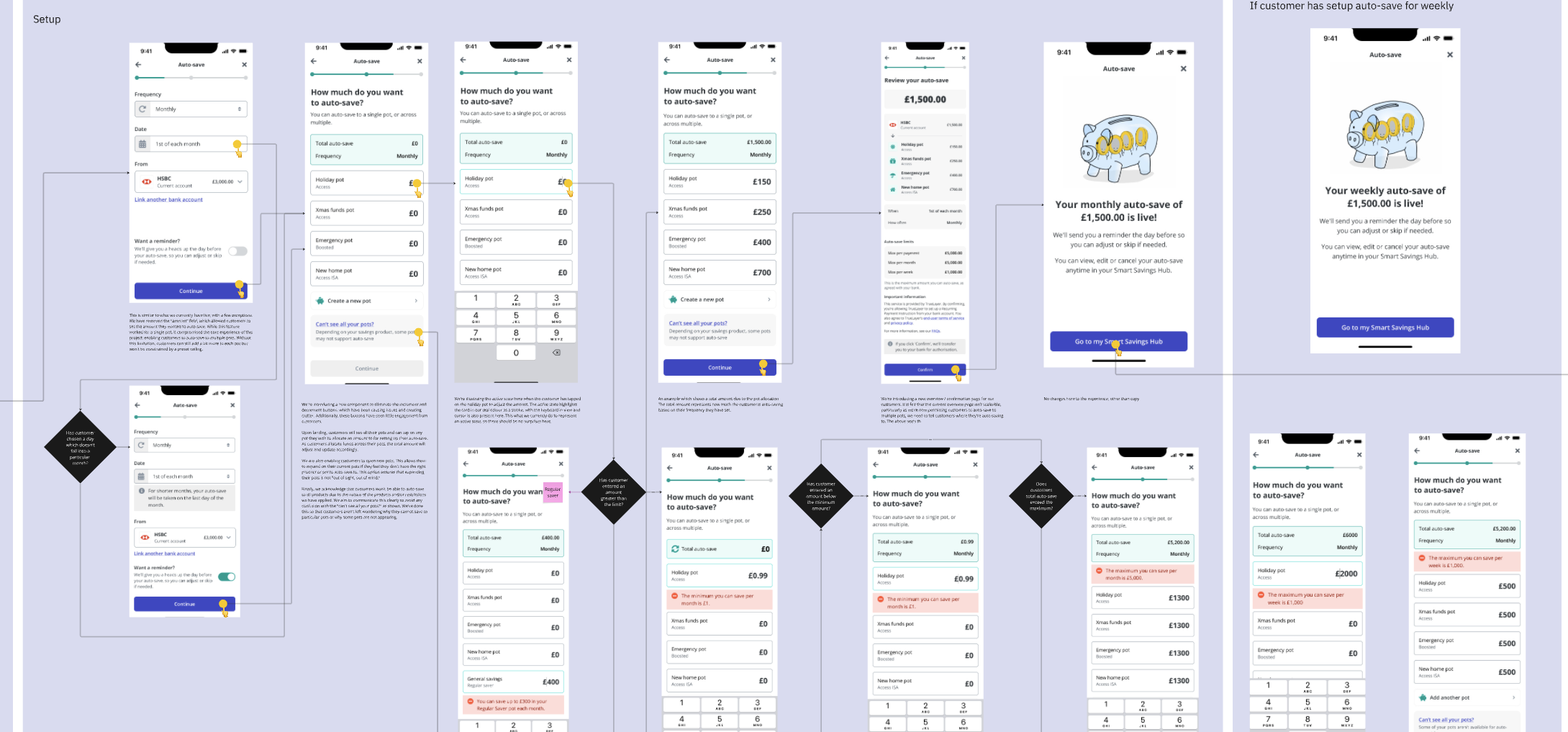

When creating the initial wireframes, my goal was to explore different approaches to how Auto-Save could work across multiple pots while keeping the experience intuitive and lightweight. I started by experimenting with navigation patterns to understand where users would most naturally expect to set up Auto-Save — whether from a centralised hub or directly within individual pots. I also tested different types of allocation inputs, comparing sliders for quick, visual adjustments against number fields for users who wanted more precision and control. A key focus was on how to visualise the split of funds clearly so customers could confidently see where their money would go before confirming. Finally, I explored placement within the journey, testing whether Auto-Save made more sense as part of the initial deposit flow or as a standalone setup process. These explorations helped us surface early insights and shape hypotheses for usability testing.

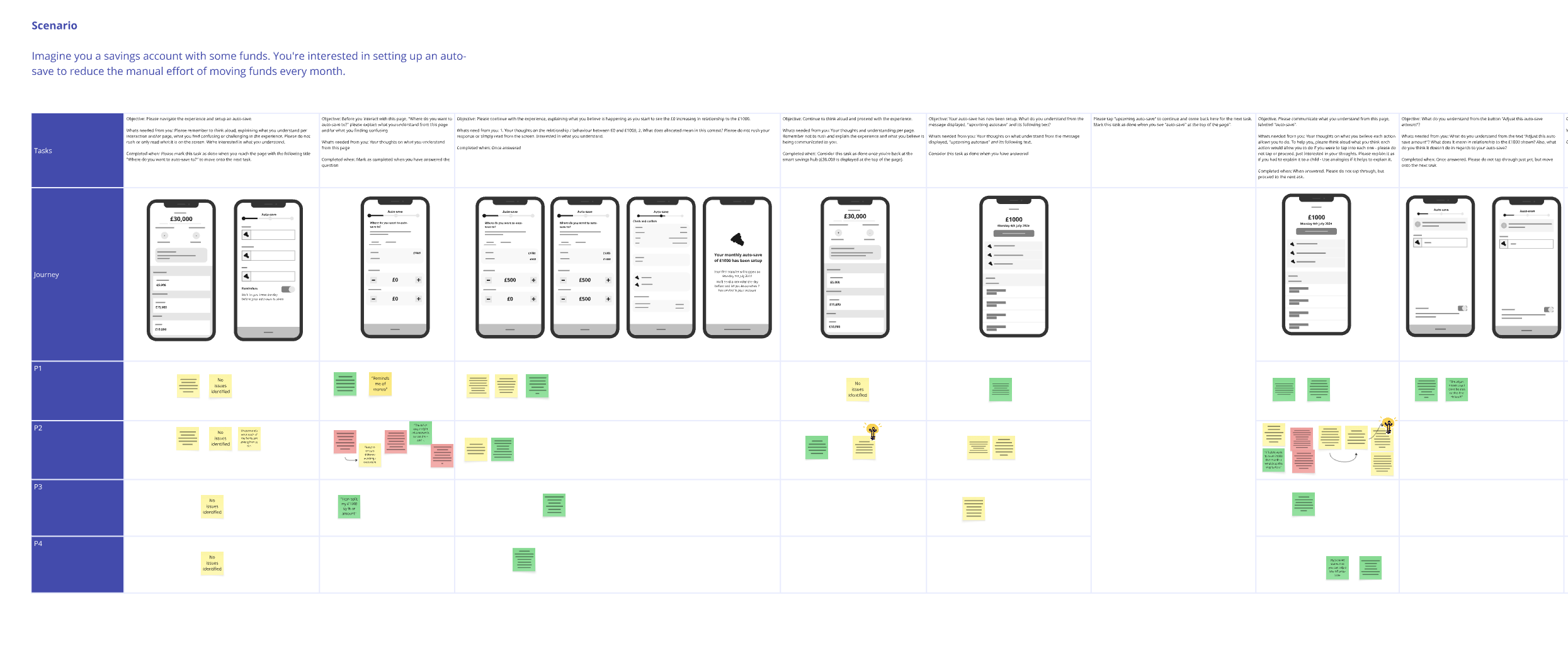

We ran remote usability testing sessions with a diverse mix of customers, including single-pot savers, multi-pot savers, and those already using Auto-Save. The goal was to understand how customers interacted with the proposed flows, validate our assumptions, and identify any areas of friction before investing further in high-fidelity designs. During the sessions, we explored three different journeys, a simple single-rule Auto-Save setup, a flexible multi-rule version, and a hybrid approach combining both. We observed where customers expected to set up Auto-Save, how easily they could allocate deposits across pots, and whether the visualisation of splits built confidence in their choices. These tests revealed that customers valued simplicity first, but also wanted optional flexibility through overrides when needed.

Customers preferred a default, single Auto-Save rule for simplicity but expected the ability to override allocations per pot when needed. This led us to adopt a hybrid MVP model: one global rule, with optional per-pot customisation.

Participants preferred going to the effort of manually entering in numbers rather than a slider as it gives confidence to locking in a decisionWhilst some think in percentages, it was easier for participants to manually input rather than try to interpret a percentage of split

Most users looked for Auto-Save within their existing pots rather than a centralised settings menu.We adjusted our MVP so Auto-Save can be accessed inline at pot level, while still maintaining a central hub for visibility across all pots.

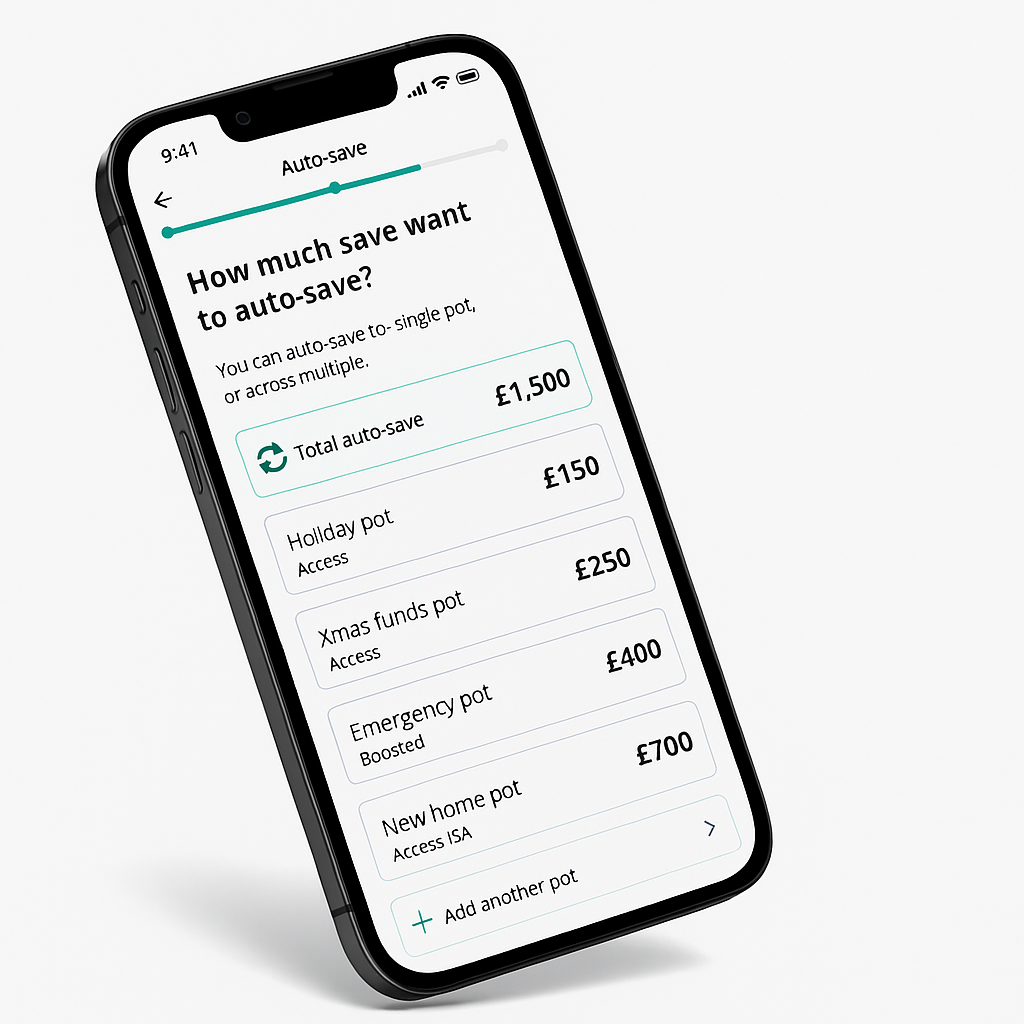

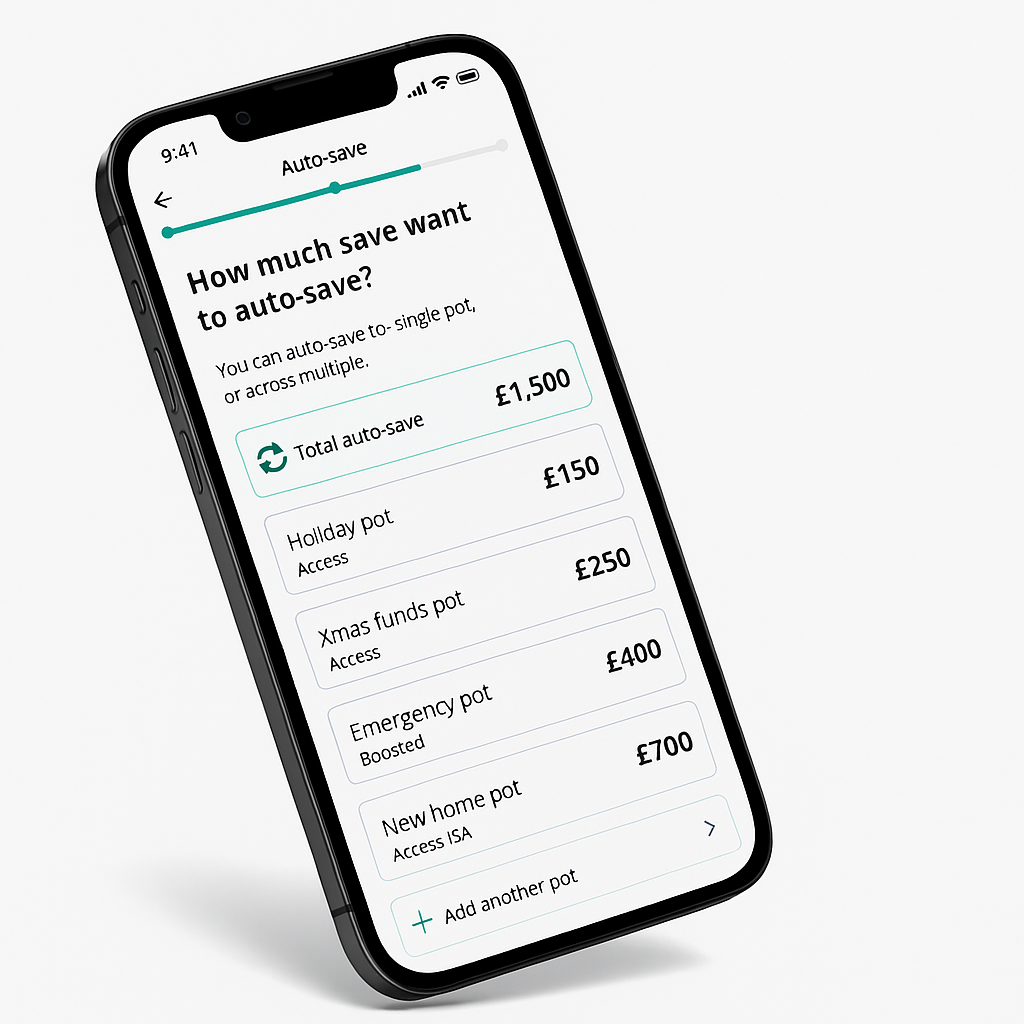

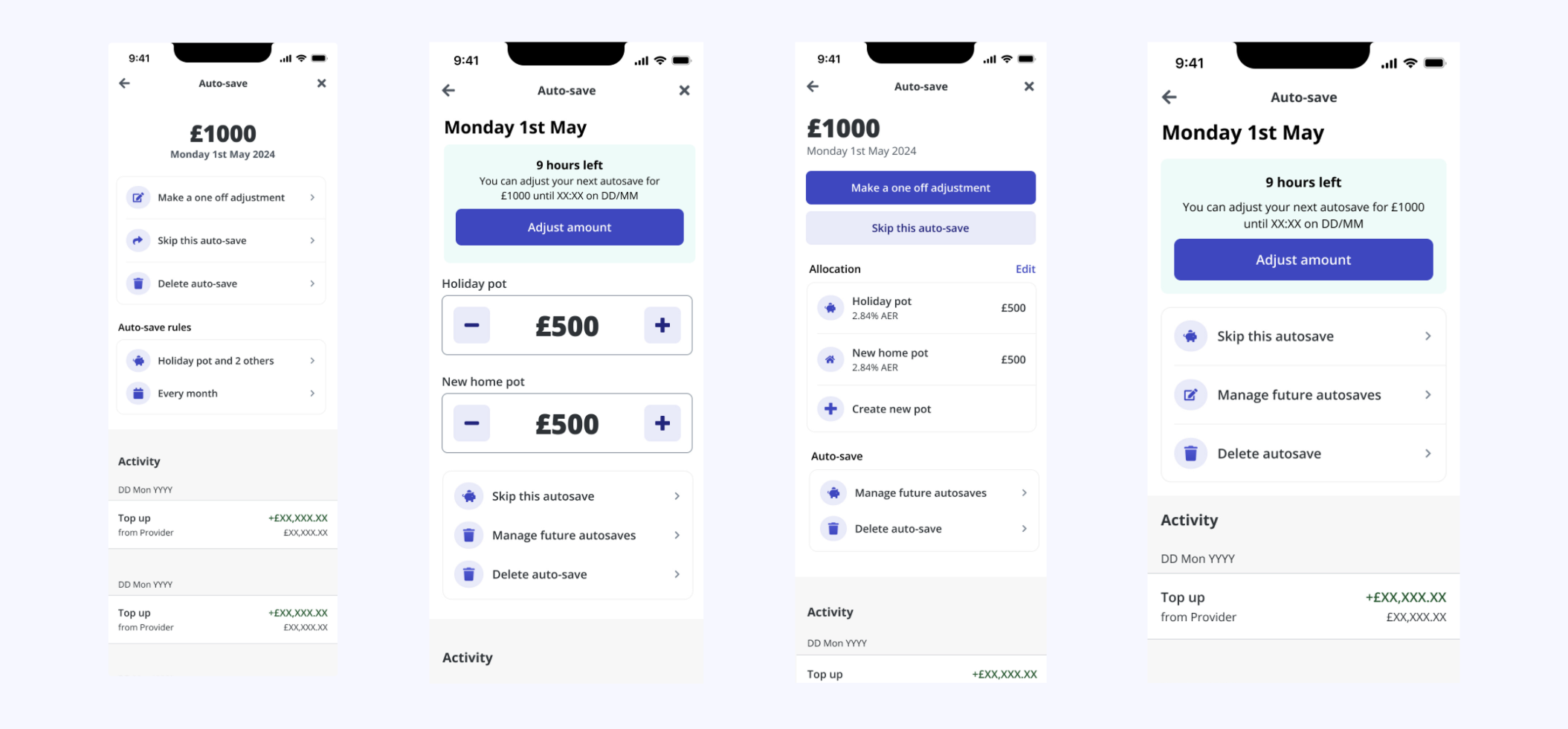

After validating our hypotheses and testing early wireframes with customers, I moved into high-fidelity design to explore how the Auto-Save to multiple pots experience could look and feel in the app. The goal at this stage was to refine the interaction patterns, visual hierarchy, and information density while maintaining clarity and trust around automation. One of the key challenges was finding the right balance between flexibility and simplicity. From usability testing, we learned that customers wanted the ability to override allocations per pot, but didn’t want the process to feel heavy or overly complex.

Once the high-fidelity designs were ready, I ran a museum tour with the core team to walkthrough the high fidelity thinking so that I had consensus and a way forward. Through dot voting and discussion, we landed with a core experience we were happy to proceed with, but knew we needed that bit more additional testing to ensure we had the right confidence in the direction we wanted to head in.

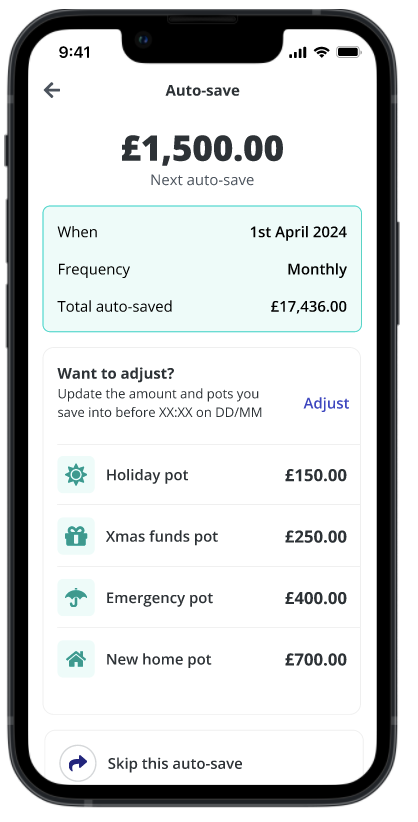

With Auto-Save, we set out to create a savings experience that felt both simple and empowering. Customers could set up recurring contributions in just a few steps, with clear pathways for allocating money across multiple pots and goals. The result was an end-to-end flow that not only encouraged customers to build consistent saving habits, but also delivered on usability standards they expected from a fintech. By making the process smooth, intuitive, and aligned with customer goals, we unlocked a meaningful lever for both adoption and retention.

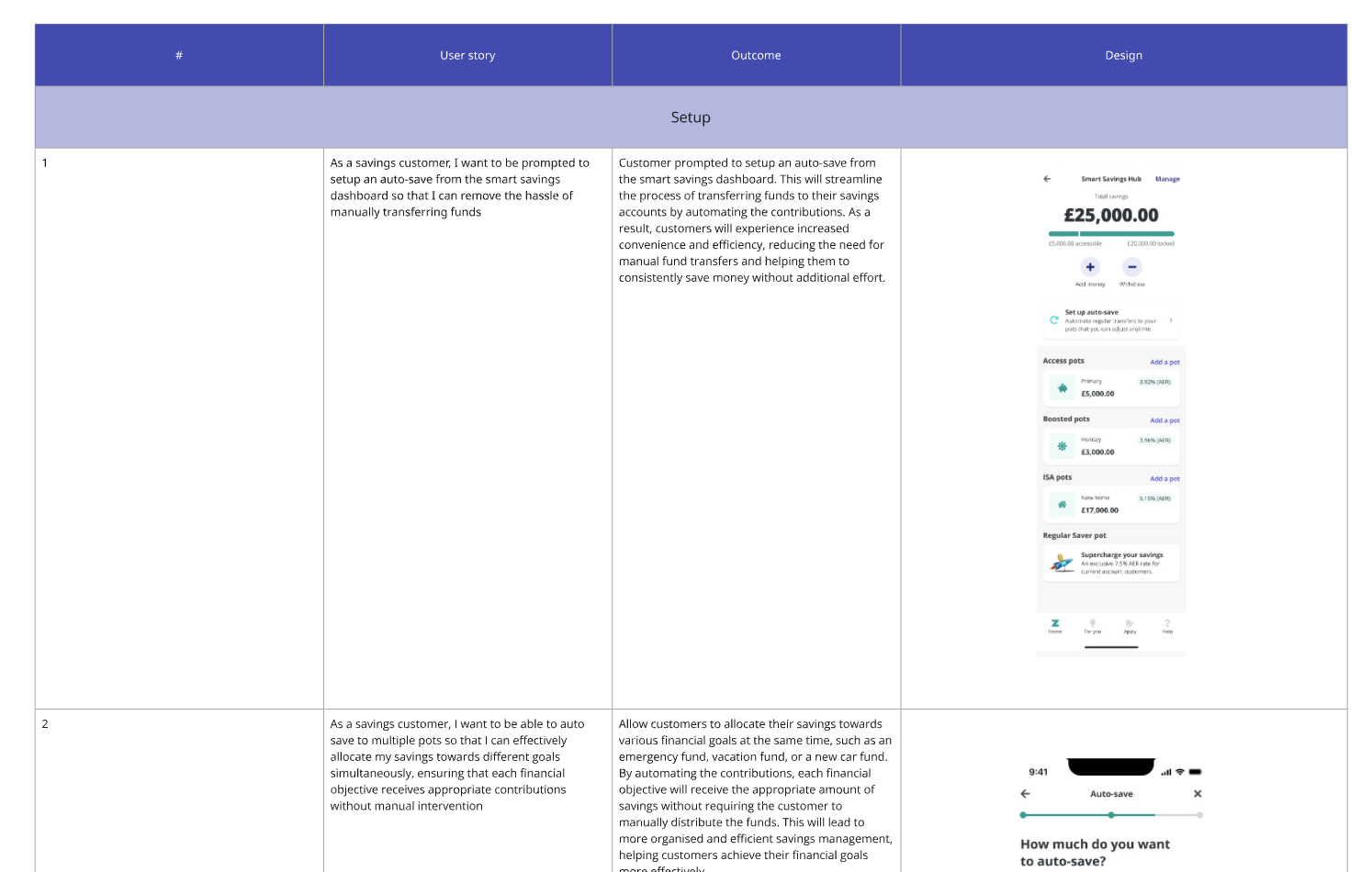

Once we had validated the designs through usability testing and aligned on the hybrid Auto-Save model for MVP, the next step was to prepare a structured development handover. Given the complexity of allowing customers to auto-save across multiple pots, I worked closely with our engineers and product team to ensure that requirements were clear, testable, and prioritised effectively.To support the build, I created a detailed set of user stories that captured:

42%

82%

£4.8m

129% More customers automating savings directly drove a significant uplift in inflows.

Adoption rate (% of eligible

customers enabling auto-save)

+129% More customers automating savings directly drove a significant uplift in inflows.

The Auto-Save to Multiple Pots project was an impactful initiative and I'm pleased I had the opportunity to deliver this for both our customers and the busines as we delivered signifanct value. Whilst the outcomes far exceeded expectations, the project surfaced several key lessons about designing for flexibility.

Working with design system constraints: Zopa’s existing design system wasn’t initially built for complex, multi-step financial flows like this. To move forward, we had to extend components carefully, introducing adjustable allocation controls and summary patterns, while collaborating with the design system team to ensure consistency and scalability.